Back home

The organization must also develop an asset identification system to allow a unique identity to each individual asset in the organization. Without an asset registry, there will be no asset management, as we do not know what asset to manage. This is the first function of an information system that needs to be fulfilled before proceeding on to other systems as in the diagram above.

A simple audit will suffice to determine the current position of the organization in the asset management information system maturity model. From this model, a strategic framework on asset management information system will be developed in conjunction with the strategic framework on asset management of the organization.

System Interfacing

The information system must be able to interface with the existing manual or computerized system that is in existence in the organization. During the development phase, decision has to be made to either upgrade or interface with the existing system. This is crucial and the decision has to be made using asset management principles.

It is also worthwhile to look in newer technologies such as Geographical Information System (GIS), Global Positioning System (GPS), real-time condition monitoring system or even Remote Identification System using radio frequency identification device (RFID) and incorporate these technologies in the information system.

The organization has also to look at interfacing of field data from third parties or proprietary equipments/software especially on condition assessment equipments, off site or field measuring equipments, mobile field scanners, hand-held inputting device and so forth.

An information system without interfacing capabilities will be not be an effective system.

Data Management

The integrity of data must be ensured at all stages of collection and inputting of data. Introduction of a specific process in data collection and input will ensure the following, that is:

Web pages are communication tool between a web producer and a web user. Asstrangers get together for the first time and share their first impressions, the web producerand the reader share their impressions and communicate through a web. In the same waythat we think it is important to choose an appropriate color and design for an importantevent, it is crucial to choose appropriate color schemes to convey images and messageson your web page.

Color is a central part of our lives. People look at and react to different colors,tints, and shades thousands time every day. People rely on colors to convey meanings formany things. Color has both emotional and psychological impacts. Colors can captureour attention and cause us to react based on our own experiences and beliefs. Webdesignersmust be very familiar with effects of colors.

This paper includes the basic rules of color theory and the functions of color.Subtopics expand the discussion of the effects of colors on mood, color symbolism,readability, legibility, consistency and accessibility. Examples of effective andineffective usage of color will be discussed.

Significance of the topic

By examining the basic rules of color theory and effects of colors, a web designercan develop more appealing and effective web pages which are more likely to sendimages and messages of the site to users directly and effectively. Comparing effectiveand ineffective examples of web sites will help us develop professional eyes and skills forproducing the most effective web site.

Basic Rules of Color Theory

Functions of Colors

Effects of Color on Mood

Color can control or affect the look and feel of the web site. Adding a few colors

can make a boring site exciting, a good site ugly, or can evoke emotional responses.

Therefore, designers should have colors to enhance their sites by creating good visual and

emotional effects. Colors should help the reader/user to enjoy the web-experience.

Here are some examples about how color influences mood:

Pink: soothes, acquiesces; promotes affability and affection.

Yellow: expands, cheers; increases energy.

White: purifies, energizes, unifies; in combination, enlivens all other colors.

Black: disciplines, authorizes, strengthens; encourages independence.

Orange: cheers, commands; stimulates appetites, conversation, and charity.

Red: empowers, stimulates, dramatizes, competes; symbolizes passion.

Green: balances, normalizes, refreshes; encourages emotional growth.

Purple: comforts, spiritualizes; creates mystery and draws out intuition.

Blue: relaxes, refreshes, cools; produces tranquil feelings and peaceful moods.

Performance Management in Asset Management

Introduction to performance management

Much has been said about performance management where an organization has to measure its progress towards achieving its goals and objectives. In fact, most successful organization put much emphasis on performance management as one of the major management tools. Performance management has evolved from a mere financial reporting tool to become a major decision-making tool. Much of its success comes from the fact that organizations have become so big and widely dispersed all over the country and the board of directors needs to know the well-being of its company fast and real-time. Furthermore, performance management has become the most effective system in creating a goal-oriented culture in government agencies.

Performance management involves establishing data collection system, analytical tools, periodic or regular monitoring and reporting, communicating the performance, continual improvement programme and lastly, using suitable indicators. Even the display of the periodic monitoring and reporting mechanism, has evolve from a mere paper-based report to a more sophisticated online or real-time electronic system, which is predominantly known as dashboard. Some would say that performance management is only meant for the chairperson, board of directors or the head of an organization, but this is not the true scenario now. Performance management is a must for any dynamic and learning organization.

Performance is measured at every level and unit, which is the cascading approach in performance measurement. This is because that in every level and unit, the unit’s performance will reflect back on the overall performance of the organization and the unit must be aligned to the organization’s objective(s). Their performance indicator is not the key performance indicator of the organization, but their indicator merely shows the unit’s contribution to the overall performance of the organization. It shows their commitment and involvement in realizing the organization’s objective(s).

Nevertheless, the top-to-bottom cascading nature of indicator(s) in an organization is an important fundamental element in performance management. Rightfully, the lowest of the personnel must know the key performance indicator of the organization because their involvement is important to the success of the organizational performance management and for the organization to be able to see the actual big picture of its performance.

Performance management is not only meant for an organization but it is also meant for products and services rendered. It also focus on the effectiveness of the organization’s delivery system and aligning the whole organization towards achieving its goals and objectives. This is done by having a performance management plan (which incorporates the processes, systems and communication plan) and suitable key performance indicators.

The benefits of using performance management are as follows:

What are indicators?

There are three (3) types of indicators, which commonly known as:

Performance Management Process

In balanced scorecard concept, vision and objective are important input to measures. Hence, there are four (4) perspectives that need to be considered when putting up measures. The four (4) perspectives are as follows:

When identifying the key performance indicators, organization must reflect the above perspective(s) besides fulfilling the SMART requirements, otherwise the indicators are either results or performance indicators. The two (2) indicators will however demonstrate the overall picture of the organization, but not its performance.

(SMART: S= specific, M= measurable, A= attainable, R= realistic, T= time-bound or timely)

In establishing the key performance indicator, the top-down is more commonly used rather than bottom-up process. An illustration of this approach is shown below.

Typically, the performance management process specifically for asset management is as follows:(Please follow the links to read the topics)

Asset Management Tools

Asset Management Fundamentals:

By simulating, we are asking questions about its behavior as a whole and we are looking beyond the fundamentals, and that is the beauty of system thinking.

Reading material:

A simple asset risk management model is shown below:

Risk Identification

External risk comes from external factors such financial risk, strategic risk, operational risk and hazard risk. Internally, the risks are nearer to the organization such as information systems, work force, internal financial control and so forth. The risk must be identified all activities and processes of an asset life cycle. There is risk in human behaviour such as unexpected behaviour and misinterpretation of instruction, which can categorized in any of the external and internal risk.

A simple template or even a questionnaire such as the figure below will assist in identifying all risks.

Risk Analysis

Once the organization has identified all risks that will be encountered, the risks are rated according to the probability of occurrence, criticality, impact and importance. All risks must rated to determine its mitigation priority, and it is done systematically by first looking at its probable effect to the asset. For example, unexpected human behaviour will cause rapid deterioration to the asset due to, such as, uncontrollable anger towards the asset. Another example would be that changes in customer would make the asset obsolete in shorter period, which new asset need to be planned and this mean capital expenditure.

A sample template is shown below:

Risk Evaluation

Risk evaluation involves processes to establish the costs, compliance to legal requirements or even environmental factors. This is done after risk analysis, which involve primarily rating the risk. There are a few factors that need to be considered in proposing a treatment such as the cost of mitigation, the effectiveness of treatment and compliance to existing legal environment.

Furthermore, risk evaluation involves decision-making on the risk and the impact of the risk to the organization and the asset concern whether to accept the risk without treatment or with the proposed treatment. Once the decision to treat the risks is accepted, the next step would be to treat the risk.

Risk Mitigation and Treatment

Risk mitigation and treatment is the process to reduce or even nullify a risk using the appropriate or proposed method. The process needs to be constantly monitored and communicate back to the stakeholders on the treatment effectiveness.

Risk Review

Risk review is a process of monitoring of the risk mitigation/treatment and emergence of new risks. Risk review also will highlight the effectiveness of the treatment, any issues in implementation of the mitigation measures and so forth. These reviews will be the basis of effective risk mitigation and treatment whilst acting as a knowledge database.

Risk Reporting

The risk management team shall generate and distribute periodic reports to stakeholders on implementation of the risk management program. The stakeholders need to know that the risk is effectively treated and the actual cost the organization has to bear.

Risk Management Plan

At the end of the day, the organization will have a risk management plan comprising of the above topic. The plan shall contain amongst others the structure for risk management, risk management policy, role and responsibility, monitoring frequency and so forth.

Publication

Rehabilitation costs

Administrative costs

Depreciation and disposal costs

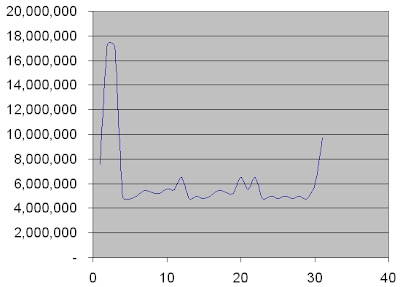

Typically, a whole life cycle cost curve will look lik this:

- Renewal cost inclusive any design, demolishing, and et cetera

- Disposal costs

- Replacement cost

- Depreciation cost